The City of South Bend recognizes that small businesses are the backbone of our community. Small business owners have always supported South Bend, particularly through its recent growth, and make our city a better place to call home.

Small business owners have already experienced losses in revenues and face unprecedented and catastrophic losses in the coming months due to COVID-19. While we cannot predict with certainty the extent of this problem, we know that immediate, targeted help for entrepreneurs will mean the difference between businesses surviving this crisis or going under.

Small Business Grants

Does your business qualify?

Businesses are required to be located in South Bend, be open for business, and employ 50 employees or less. A full list of requirements can be found on the application.

Businesses will also be asked to demonstrate a negative impact as a result of the pandemic. Accion and the City of South Bend have worked to be as flexible as possible on this topic, and questions on required documentation should be directed to Accion using this form.

How to apply

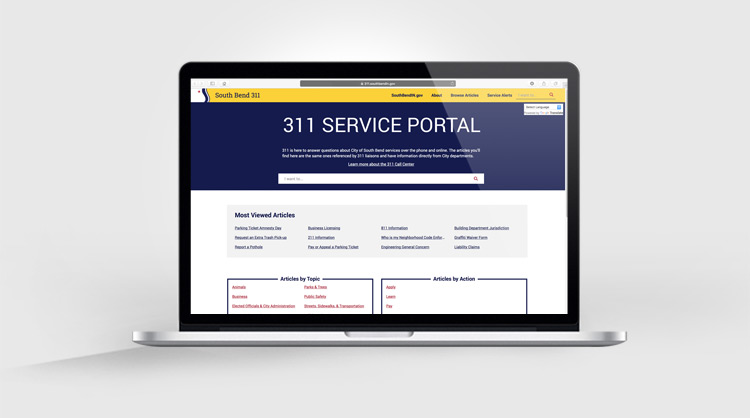

To apply for the Small Business Resiliency Grant Program through Accion, follow this link. The application window is from July 29 at 6pm until August 7 at 6pm.

Small Business Loans

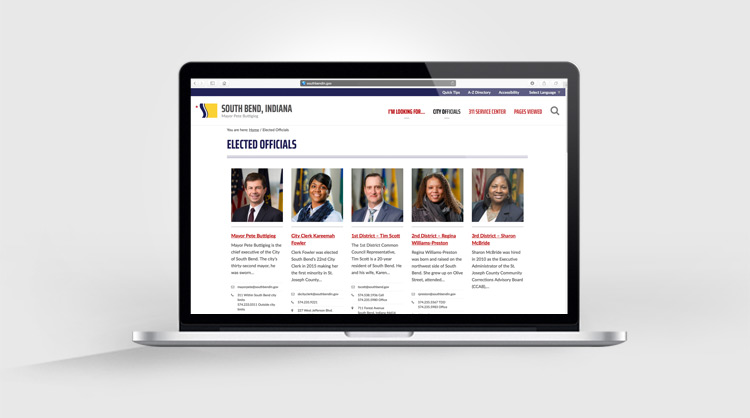

The City is working with community development financial institutions (CDFIs) and local financial institutions to develop resources that will prioritize helping smaller, local businesses, who have not been the main target of other aid packages at the State or Federal level.

QuickBridge and Reboot Loans for South Bend Small Businesses (Bankable)

The City is partnering with two CDFIs, Bankable and Accion Serving Illinois and Indiana, who will administer the emergency small business loans. Both organizations have long track records of lending to under-resourced borrowers, including a focus on equity and inclusion. The two loan programs are:

In response to the COVID-19 pandemic, the City of South Bend partnered with Bankable to bring their QuickBridge and Reboot Loan programs to small businesses in our community. Both these loans will be available to businesses with under 50 employees located within the City of South Bend and will be capped at $20,000. The Bankable Quickbridge Loans are for businesses who are still operating and generating sales. These loans are meant to help offset decrease in sales, slow pay customers, increase COGS, etc. Bankable Reboot Loans are directed at for-profit businesses that have had to close due to COVID-19 but would like to leverage loans to reopen. Bankable will make independent determinations and will communicate with all applicants, those who will proceed and those who will not. The application, eligibility criteria, maximum loan amount, terms, and other details can be found here.

Emergency Assistance Fair | April 17, 2020

In order to help as many South Bend small businesses as possible learn more about the emergency loans and other COVID-19 relief, the City hosted an Emergency Assistance Fair (EAF) on Friday, April 17. Each breakout session contains Q&A with the financial institutions about potential loans. Contact and application information can be found in the Resource Guide and links below. To find out more about local financial institutions’ offerings, including Bankable and Accion’s programs, click the links below to see the recordings of the Fair:

- Full playlist

- General session, general session transcript

- Breakout sessions