ABOUT THE REVOLVING LOAN FUND

The Recovery RLF offers commercial loans up to $1.5m as part of the Coronavirus Aid Relief and Economic Securities (CARES) Act that was approved by Congress on March 27th, 2020.

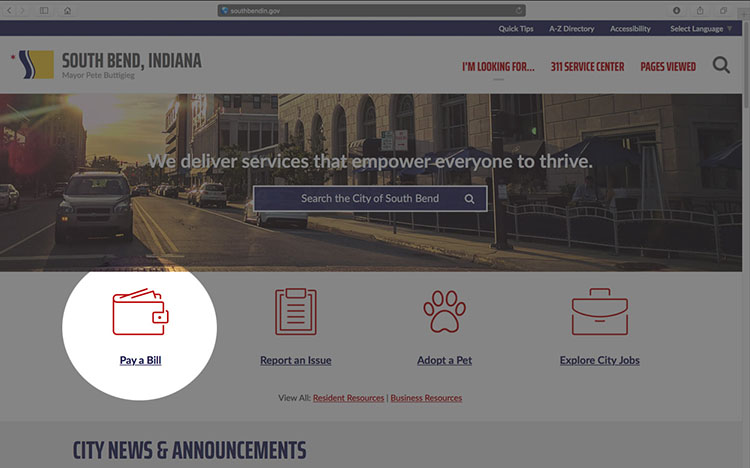

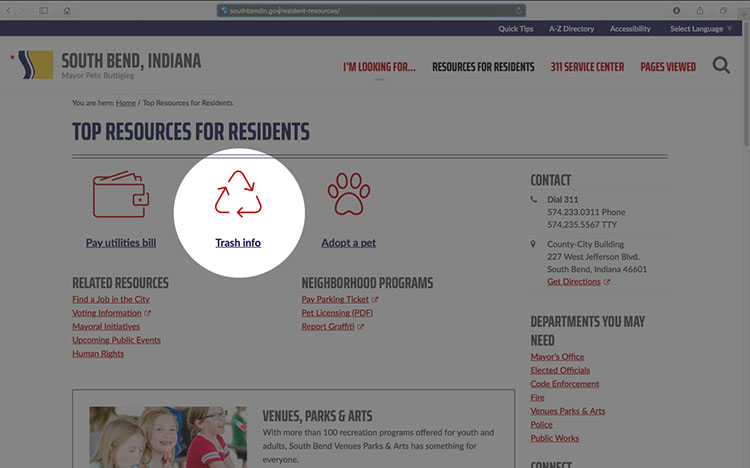

The Recovery RLF program seeks to revitalize the landscape of industry and opportunity in South Bend. The City always thrives by attracting innovation, entrepreneurship, and employment opportunities. The loan fund is specifically focused on accelerating the recovery for new and existing businesses in South Bend.

MISSION

The Recovery Revolving Loan Fund seeks to…

- Recover and retain existing businesses

- Encourage and attract new businesses

- Promote an economy which supports business

- Improve capital access for local businessess

GAP FINANCING

Due to the pandemic, a number of small businesses had to close their doors. Some entrepreneurs have started a new business. But start-ups and small businesses are often at a disadvantage when it comes to conventional lending. A business needs capital to develop its product, but the bank needs to see a product to approve the business capital. The Recovery RLF is designed to provide help where conventional lending may fall short.

The Recovery RLF also satisfies conventional lenders by offering gap financing. Our loan fund makes up the difference between a business loan request and a lender’s threshold.

REVOLVING LOAN FUND

Home

Information

Loan Options

Eligibility

Get Approved

Department of Community Investment

227 West Jefferson Blvd.

Suite 1400 S

South Bend, IN 46601

574-235-5838