WHO IS ELIGIBLE?

The most important qualification for a loan through the Recovery RLF program is dedication and commitment to your business, especially at this challenging time. We look for businesses with an experienced and passionate management team who have been continuing their operations and retaining jobs.

HOW IT WORKS

Start with a prescreening application which can be found here. Once you have this application completed, a team member will be in touch to guide you step-by-step through the rest of the process. If your business is eligible for recovery loan funds, we walk you through the loan application process which includes due diligence and underwriting.

IDENTIFY NEEDS

The City of South Bend wants your business to recover and succeed, and the Recovery RLF is here to help make that happen. It begins by identifying your business’s financial needs.

What is your project and for what will the loan be used? Make a conclusive list, documenting the need for funds, how the funds will be applied, and the projected change to workflow/budget.

REVOLVING LOAN FUND

Home

Information

Loan Options

Eligibility

Get Approved

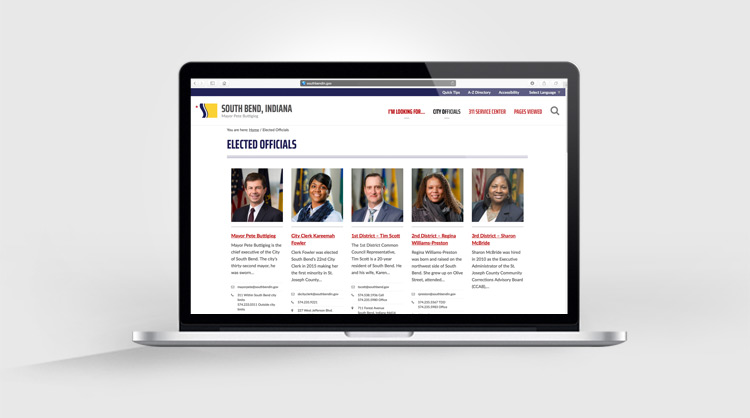

Department of Community Investment

227 West Jefferson Blvd.

Suite 1400 S

South Bend, IN 46601

574-235-5838

RLF LOAN APPLICANT CRITERIA

The criteria for RLF loan applicants include the following stipulations:

- The applicant is located in the City of South Bend, IN.

- Small business has been impacted by COVID-19.

- The business is a for-profit enterprise.