Please note that as of July 1, 2022, net metering (a full retail rate credit for the electricity your system produces and sends to your neighbors) is no longer available to new solar owners. You can learn more about net metering in Indiana from Solar United Neighbors here and about the credit that replaced net metering, called “excess distributed generation (EDG),” here. There is currently a court case before the Indiana Supreme Court to determine how EDG credits are measured (“instantaneous netting” versus “monthly netting”), and the Court will hopefully make a decision on the case by the first half of 2023.

Save money, decrease your carbon footprint, and improve your energy security by installing solar panels on your property!

Before Going Solar

Before Going Solar, You Should:

- Own your home or property

- Have roof in good condition (one that won’t need replacing before you break even on your investment) OR

- Have adequate space for a system to be installed on the ground

Not a homeowner or property owner?

Solar Installers

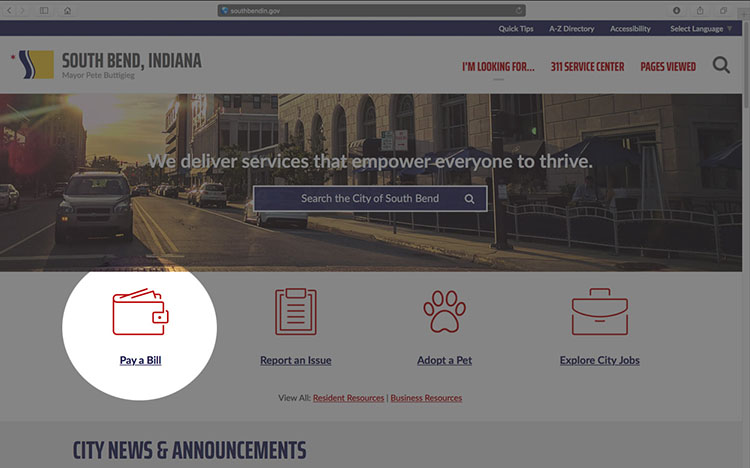

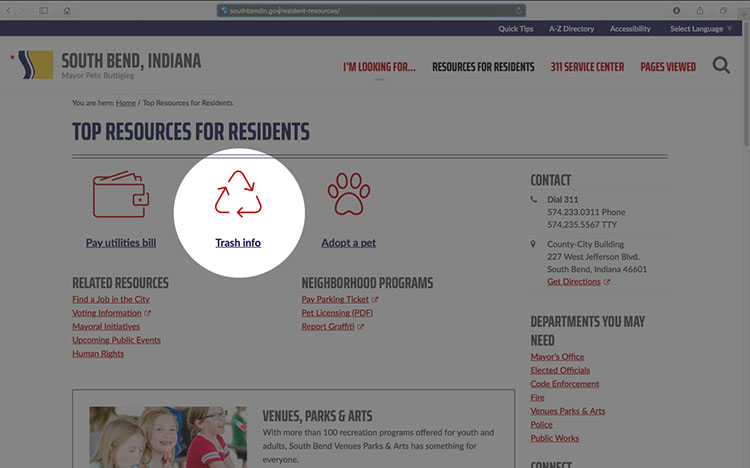

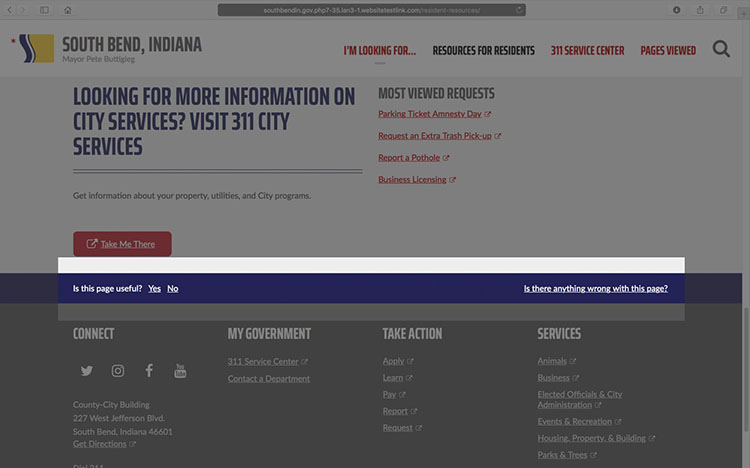

Find more info on South Bend permitting and approval processes by going to the 311 Solar Energy page.

Learn The Solar Basics

Facts: Solar Technology, Cost, and Size

How Solar Works

BETWEEN $10,000 AND $20,000

Estimated total residential solar system costs (before applying the 30% federal tax credit)

BETWEEN 4KW AND 8KW

Size of average residential solar system size.

A 9.3 kW system in South Bend would produce roughly the same amount of electricity that the average home in Indiana consumes in a year

Tips: Reduce Your Solar Costs

Check out these ways to reduce your payback period, or the amount of time it takes to earn back your initial investment from savings in your utility bills:

JOIN A SOLAR CO-OP

Keep an eye out for future solar co-ops in the area. Solar United Neighbors and Solarize Indiana launched the Northern Indiana Solar and EV Charger co-op, in July 2021 and installed over 120kW of solar throughout the year. Co-op members leveraged bulk-purchasing power to get discounted pricing and a quality installation.

Learn more about the co-op experience by watching this Indiana Solar 101 webinar.

APPLY FOR EASSI

If your nonprofit owns or leases its facility in South Bend, apply for the Energy Assistance and Solar Savings Initiative. Your organization will be able to access solar energy and improve your energy efficiency!

EASSI provides subsidized energy assessments, grants, and low-interest loans.

CLAIM YOUR 30% FEDERAL TAX CREDIT

File IRS Form 5695 as part of your tax return. If you end up with a bigger credit than you have income tax due, you can carry the credit over to the following tax year. Consult a tax professional to guide you through this process.

Small businesses can also access this tax credit! Learn more about the 30% federal tax credit on SEIA’s and Turbotax’s websites.

Frequently Asked Questions

Do we get enough sun in South Bend for solar?

How much electricity do homes typically use?

Electricity consumption varies significantly between households. For example, it depends on the size of the home, how you heat your home, how much you use an air conditioner, whether you’ve switched your light bulbs to LEDs, if the attic space is well-insulated, etc.

In 2020, in Indiana, the average electricity consumption was 938 kWh monthly; 11,256 kWh annually. (See full U.S. Energy Information Administration report here and see how Indiana’s average usage is high compared to our neighboring states.)

A 9.3 kW system produces about the same amount of electricity that the average home in Indiana consumes in a year. But, newer homes may be much more efficient.

What if my property is in a Local Historic District?

Solar projects in Local Historic Districts require a Certificate of Appropriateness.

To apply or find more information about each District’s Standards and Guidelines, visit the Historic Preservation Commission.

What if I am part of a Homeowners Association?

If you live in a neighborhood with a Homeowner Association (HOA), you may need to go through an approval process required by the covenant.

See SUN’s HOA Solar Action Guide for tips on how to work with your HOA.

How much do batteries cost?

It all depends what you want to power (your whole house, or just critical loads) and for how long in the case of a power outage.

However, on average, battery storage costs can range from $7,000 to $20,000. These estimates include soft costs (installation, permitting, system design, labor) and hardware costs (equipment, inverter, other electrical components.)

The Federal Investment Tax Credit that is available for solar installations can also cover the cost of battery storage. According to the IRS, a battery system on your home must be 100% charged by solar energy to receive the credit.

Different rules apply to commercial battery systems, which can receive a portion of the ITC if at least 75% of their charge comes from solar. Read SUN’s Battery Storage Guide to learn more.

Will adding solar to my property increase my property taxes?

A state law protects you from paying higher taxes on the added value of solar on your property.

If your assessor were to increase your assessed value due to solar, then the law requires them to deduct a corresponding amount for solar before calculating your property taxes.

Solar has a neutral effect on your current property taxes. It does not make them go up, and it cannot make that go down.

How long do panels last?

Solar panels will produce electricity for decades. In fact, solar panels from the 1970s and 1980s are still producing electricity, though they slowly “degrade” or produce less electricity over time.

The rate depends on the panel quality, but a typical panel may degrade on average 0.5% per year. Most panels today come with a performance warranty which, for example, may guarantee the company’s panels will produce at least 80% of the power they did on Day 1 after 25 years.

After the warranty period, they will likely continue to generate electricity but at some point, the owner may choose to upgrade to new panels. See more about solar system warranties on SUN’s FAQ page.

What is the difference between kW and kWh?

The system size, or “capacity” of a solar PV system is stated in terms of kilowatts, or kW. This is a measure of the potential power or instantaneous rate of energy generation.

Peak power defines a solar system’s size — a 6kW system will generate up to 6kW of electricity on a perfectly sunny day when the sun is strong.

Kilowatt-hours (kWh) is a unit used to measure the amount of electrical energy used over time. Kilowatt-hours are a measure of total energy consumed.

If the panels on your system continuously output 6 kW for a whole 60 minutes, you will have produced 6 kWh of energy.

The amount of electricity you use (or generate) is defined in kWhs. For example, you might say “My solar system produced 10 kWh of electricity today!”

Installing panels on my roof isn’t going to work for me right now. Can I purchase shares in a community solar project?

Some incentives and programs available in many other states are not available in Indiana or South Bend, such as Property Assessed Clean Energy (PACE), leasing programs, and community solar.

As described on SUN’s website, community solar offers the benefit of solar to those who can’t, or prefer not to, install solar panels on their homes. These projects enable individuals, businesses, or organizations to purchase or subscribe to a “share” in a community solar project.

If you join a community solar project, you receive a credit on your electric bill each month for the energy produced by your share.

Before you can receive this credit, though, your utility must agree to participate in community solar, or be forced to allow it by legislation.

While community solar is not available in South Bend, you do have the opportunity to support renewable energy through Indiana Michigan Power’s IM Green programs.

By subscribing to IM Green Local Renewable Program, you will subscribe to Renewable Energy Certificates (RECs) from power generated by I&M’s solar and hydro generation assets and wind procurement in Indiana, including the St. Joseph Solar Farm

More Resources:

MACOG’s Solar Energy Resources

Residential Consumer Guide to Solar Power (Solar Energy Industries Association, SEIA)

Clean Energy Consumer Bill of Rights (Interstate Renewable Energy Council, IREC)

Steps for Getting Solar Ready

1. Review your annual energy usage and find ways to reduce it

Check your electricity bills to see how much energy you’ve consumed in the past year, measured in kWh. (See the FAQ section for an explanation of the unit kilowatt hours, kWh.)

If you increase your energy efficiency, you will need less energy from your solar panels.

Visit the Office of Sustainability’s Energy Efficiency webpage to learn more. Review the rebates for energy-saving appliances provided by our local utilities and learn energy-saving tips!

2. Learn the basics about solar

Do you have adequate space and access to sunlight on your property for solar? Does solar make financial sense for you? Learn more about solar technology, economics, and installation to find out.

This Indiana Solar 101 webinar and Solar United Neighbors’ (SUN) FAQs page provide extensive, helpful background on those topics.

*Interested in adding solar to multi-family buildings? It may be more complicated than adding solar to a single-family home. Review SUN’s suggested project models for multi-family buildings to understand what’s possible.

3. Explore your solar potential

There are many online tools to help you estimate the potential solar energy production of your roof.

Estimate your annual and monthly electricity production by entering the address of your property into Google’s Project Sunroof or the National Renewable Energy Lab’s PVWatts Calculator.

Watch this explainer video to help you effectively use the PVWatts calculator.

4. Talk to people who have gone solar

Join the Solar United Neighbors of Indiana Facebook group to be connected to other individuals who have gone solar and get the latest solar news!

Also check out Southern Indiana Renewable Energy Network’s (SIREN)’s interactive map of solar installations and locate the solar systems in South Bend.

Ok, I’m Solar Ready

You’re familiar with how much energy you use throughout the year. You know the basics of solar technology and have a general sense of the solar capacity for your roof. You’re ready to start thinking about the logistics for solar installation! On average, the entire process takes about 2-4 months.

Here Are Your Next Steps

1. Estimate the size, cost, and payback time for your system

Check your electricity bills from the last 12-24 months to determine how much electricity (in kWh) you use on an annual basis.

You may want to consider different sized systems that would generate 25%, 50%, 75%, or up to 100% of your annual electricity usage.

When deciding about what size system is right for you, consider:

- How much roof or ground space is available

- Your budget

- The degree to which energy efficiency improvements could cost-effectively reduce your total electricity consumption, and

- Anticipated increases to your electricity consumption. Do you plan to get an electric vehicle or convert your natural gas appliances to electric? This will add to your electricity demand, so plan accordingly.

SUN estimates that a 4kW system purchased in Indiana in 2021 will cost approximately $7,600 and generate an estimated savings of $16,500 over its lifetime (25 years), resulting in a net profit of $8,900.

SUN estimates that an 8kW system purchased in Indiana in 2021 will cost approximately $15,200 and generate an estimated savings of $33,000 over its lifetime (25 years), resulting in a net profit of $17,800.

Check out their Indiana Solar 101 webinar for more details about the calculations and assumptions.

Typical payback periods range between 10-15 years. But they will likely become longer for new projects installed after net metering changes on July 1, 2022.

The City is encouraging South Bend residents to join Solar United Neighbors and Solarize Indiana’s Northern Indiana Solar and EV Charger Co-op before it closes at the end of February 2021.

Co-op members have access to competitive pricing for individual solar systems by leveraging their buying power with one installer.

2. Solicit quotes and select an installer

3. Research financing options

Some individuals and organizations can pay for solar projects upfront with cash. While the payback period is shorter without paying interest, you may need financing to spread the cost over time.

You might also seek out grants to reduce the upfront cost or amount borrowed.

City Programs

The Energy Assistance and Solar Savings Initiative helps nonprofits and community institutions reduce utility costs and save energy. A free energy assessment, City-sponsored grants, and access to low-interest loans from a mission-driven lender are available through this program.

We encourage nonprofits to consider solar through this program.

Non-City Programs

You can get a loan or line of credit through the financial institution(s) with which you already have a relationship. Local institutions will lend money for solar, just as they would for other home improvement projects.

Financing options do not need to be specifically designed for solar, i.e. “a solar loan”, but some may offer special rates or terms.

Installers may also connect you with a financial partner. See SUN’s list of nation-wide financing options here.

Check out available incentives that will help reduce the overall cost of your system, such as the federal tax credit and USDA grants for agricultural producers.

Install your system before July 1, 2022 to benefit from net metering.

Some incentives and programs available in many other states are not available in Indiana or South Bend, such as Property Assessed Clean Energy (PACE), leasing programs, and community solar.

Flipping The Switch

You’ve selected an installer, decided how to pay for your system, and moved forward with the agreement to purchase a system. The rest of the process follows this sequence:

Before Installation Steps:

Installer submits a request for interconnection approval

The installer will submit a request for interconnection approval from the utility. (For residents of South Bend, your installer will log into the Indiana Michigan Power (I&M)/AEP portal and submit a request.)

You sign interconnection application

You will sign the application, and it will be reviewed by I&M/AEP.

I&M/AEP conducts a completeness and a technical review of the proposed project

I&M/AEP verifies the required documentation for completeness and correctness.

Installer submits an electrical permit application for solar to the Buildings Department

The installer will submit an electrical permit application for solar to the Buildings Department.

*If the system is non-residential, larger than 11 kW, or ground-mounted or part of a new structure, the installer may need to submit more detailed information. See our Solar Photovoltaic Permit Guidelines for understanding the local approval processes.

I&M/AEP approves interconnection application and then you sign interconnection agreement

After Installation Steps

Installer installs solar system and requests inspection from Buildings Department

Once the system gets installed, the installer will call the Buildings Department for an inspection.

Buildings Department inspects system and sends proof of inspection to I&M/AEP

The inspector will do an inspection of the solar system and send the release to I&M/AEP, in the same day.

Installer submits proof of installation and inspection to I&M/AEP

The installer will upload jobsite pictures and the inspection reports to the I&M/AEP portal. I&M/AEP will verify pictures and documents submitted.

I&M/AEP signs interconnection agreement

I&M/AEP will then sign the interconnection agreement.

I&M/AEP installs specialized metering device

Next, I&M/AEP will contact you and come to install a specialized metering device (bi-directional meter) for the system.

You call installer to flip the switch

Once the new metering device is installed, you will call the installer to come turn on your system.

The installer should do a final walk through with you to show you the components of the system, what to look for, and to answer questions.