How was your experience?

CONNECT

My Government

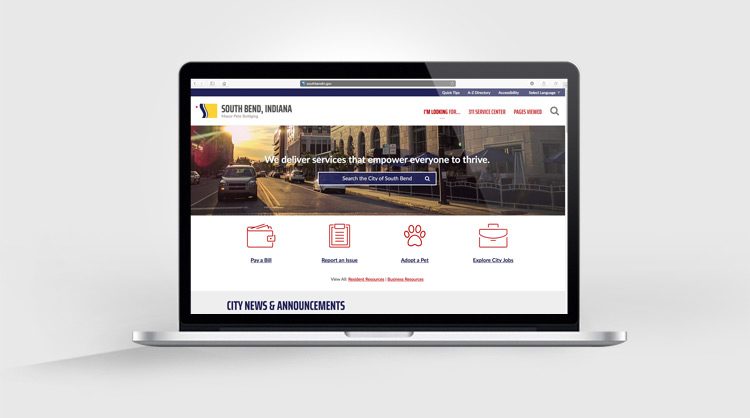

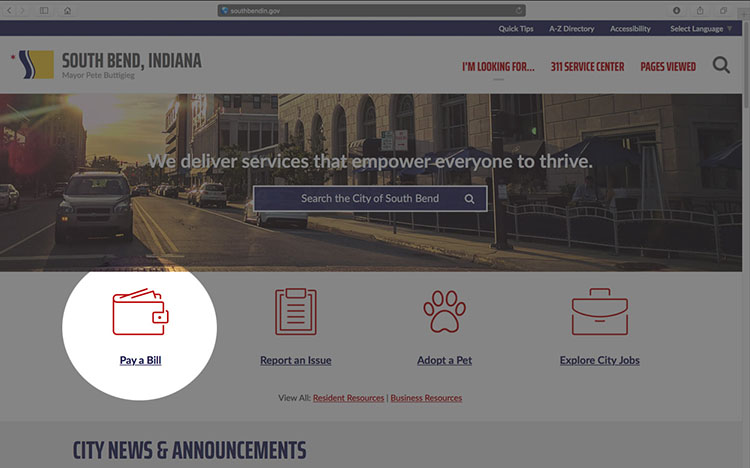

WELCOME TO THE CITY OF SOUTH BEND’S NEW WEBSITE

We’ve redesigned the website with an emphasis on better connecting you with services, facilities, and information pertaining to everyday life in South Bend. Click on the left and right arrows to navigate these quick tips to make the most of your first experience.

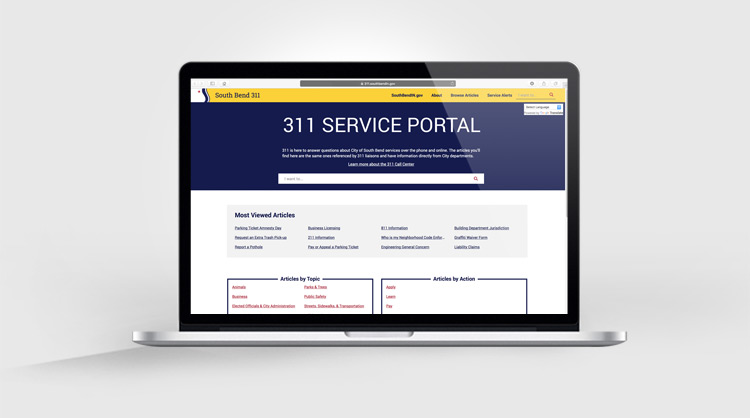

311 SERVICE CENTER

Browse topics, answer questions, and get information about City services and departments. Take me there.

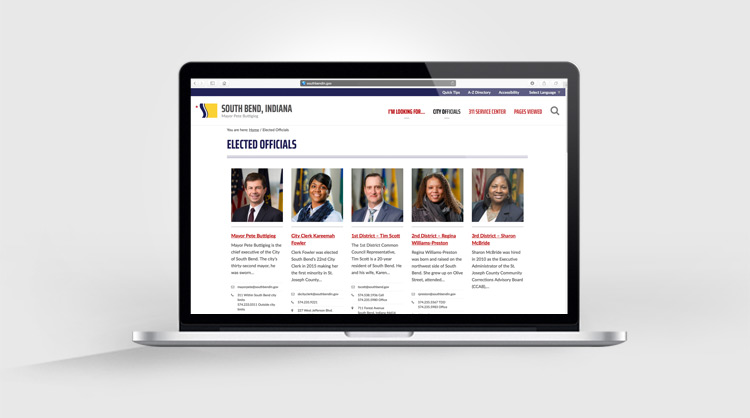

CONNECT WITH ELECTED OFFICIALS

South Bend’s city government aims to make the basics easy, deliver good government, and invest in people and places. Learn about how our elected officials are working for you. Learn more.

PAY BILLS ONLINE

We have information on how to pay utilities, parking tickets, and more. Go pay a bill now.

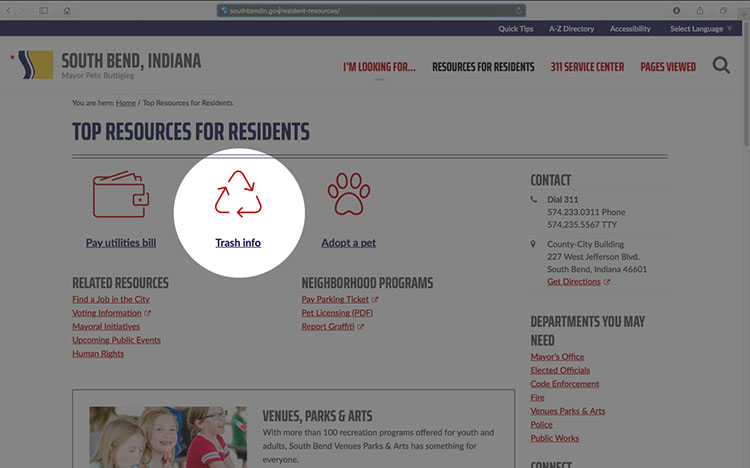

TRASH INFORMATION

Get answers to common questions like like “How do I sign-up for the City Yard Waste Program?” and others via Top Resources for Residents. Learn more.

VENUES PARKS & ARTS

Explore activities, programs, and health and fitness initiatives through Venues Parks & Arts. Learn more.

PROVIDE FEEDBACK

Our goal is to continue evolving this service to better meet your needs. Please provide feedback on how we’re doing at the bottom of any page.