Each year the Mayor, Common Council, city departments, and residents work together to craft a plan for city spending. What do you care about? Streets? Public safety? Parks? We’re aiming to set new records on resident engagement for the 2022 Budget. Scroll down to learn more, attend a meeting, or fill out our survey. Your voice matters. Build the Budget!

An introduction to the city budget

Thank you for helping us Build the 2022 Budget!

See what your community said in the report link below.

A special thank you to the Common Council for their contribution to the budget process each year.

Financial Transparency Resources

City Budget FAQ

What is the City’s budget and why is it important?

The City’s annual budget is one of our most important documents. It establishes how public funding will be spent in order to accomplish the strategic priorities of the South Bend Common Council, the Mayor, and, ultimately, the residents of South Bend. The budget also establishes the legal maximum the City is allowed to spend on these various priorities – unlike budgets in non-governmental organizations, the City’s spending budget cannot be exceeded. It is not a mandate to spend (i.e., City funds may spend less than the budgeted amount), but it does represent the legal limit of spending.

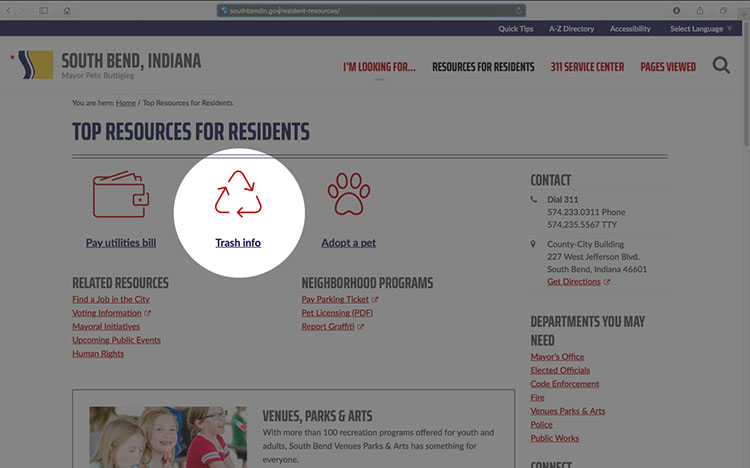

The budget is organized into services such as fire response, police patrol, or trash pickup.

How is the City’s budget established?

The budget process generally begins in May and is concluded in October, when the South Bend Common Council passes a budget ordinance for the following year. In between, the City holds input-gathering sessions with residents, and, during the months of August, September and October, the City administration presents the budget to the Common Council through a series of public presentations.

Every step of the budget process (including input-gathering sessions with residents and all public presentations of the proposed budget) is focused on strategic priorities. One important way in which the City ensures that the investments in the budget follow the strategic priorities of the City is to consider spending in two broad categories: “Baseline Spending” and “Strategic Spending”:

- Baseline Spending: Baseline Spending consists of spending that is central to the core responsibilities of the City: keeping residents safe and healthy, as well as spending that has already been committed to, such as debt service or the maintenance of current capital assets. During the budget process, the necessity of these expenditures is not questioned; rather, the budget process is designed to question how these functions can be performed in the most efficient manner. Roughly 85% of the City’s budget is baseline spending.

- Strategic Spending: Strategic Spending is designed to build upon the fundamental services provided through Baseline Spending and allow our residents to not only survive, but to thrive in the City. The budget process for determining Strategic Spending involves identifying the investments that most closely match the City’s priorities, rather than simply trying to make core services more efficient. The most question during the budget process for Strategic Spending is which investments to make in order to best reflect and accomplish the City’s priorities, including priorities in the areas of economic development, culture, and inclusivity.

How does the City fund its operations?

The City receives a variety of revenue sources to support the expenditures listed in the budget:

Tax Revenue

- Most of the core governmental operations (police, fire, parks, and administrative departments) are funded primarily by property taxes. Altogether, property taxes make up roughly 25% of all City revenues.

- Additional governmental operations (such as Code Enforcement and Community Investment) are funded primarily via income taxes. Income taxes make up about 11% of City revenues.

- The City receives a variety of smaller tax revenues, including gasoline tax, wheel tax, and liquor excise tax, which are used to support road repair and other priorities.

Charges for Services

- Many City services are funded primarily by fees charged to users. These include the water and wastewater utilities, the solid waste (trash collection) division, as well as the City’s Century Center convention center and Morris Performing Arts Center. Charges for Services make up about 30% of the City’s total budget.

Does the City have a “balanced budget”?

In normal circumstances, to promote good fiscal management and ensure adequate cash on hand, South Bend is committed to the passage of a balanced operating budget, or a budget in which operating expenditures do not exceed operating revenue. A balanced budget is necessary for proper financial management in the City of South Bend. The City defines a balanced budget as a budget in which estimated revenue and available cash balances are equal to or greater than estimated expenditures. After the budget is adopted, if increases in expenditures and/or decreases in revenue result in an imbalanced budget, then a budget amendment is required to bring the budget back in balance. Note that this definition excludes non-operating revenues and expenditures (such as large, one-time capital expenditures that are funded with debt).

How many employees does the City have?

As of the end of 2021, the City had 1,075 full-time employees. Roughly half of City employees are police officers or firefighters.

What are “funds” and why does the City have them?

Funds can be thought of as separate accounts that are used to account for specific functions. Because the City receives many different sources of revenue, and many of those revenue sources have restrictions on how they can be used, the City uses funds to ensure that those restrictions are complied with. For example, the City receives gasoline tax revenue, which is required by law to be used for street and road repair. In order to ensure that this revenue is used for the correct use, the City receives this gasoline tax revenue into a special fund and accounts for it separately from other revenue sources. In this way, the City can ensure that all expenditures of that revenue (i.e. expenditures from that fund) comply with the restrictions on the revenue.

The City maintains over 100 funds for various purposes.

How much debt does the City have?

South Bend is committed to maintaining a manageable debt level. Debt financing of large-scale capital projects (such as the redesign and rebuilding of Howard Park) and ongoing capital maintenance (such as the replacement of City fleet vehicles and equipment) is vital to the accomplishment of the City’s strategic priorities. Indeed, using debt as a lever to augment the City’s ability to accomplish large-scale projects is one of the most critical ways that the City reinvests in the community and community priorities.

However, the City recognizes that debt must be managed responsibly. Accordingly, analyses are performed before issuing new debt to ensure that adequate reserves exist and future revenue is expected to easily cover debt service payments. One of the most important goals of these analyses is to ensure that the City’s AA bond rating (which is one of the highest in Indiana) is maintained. The City’s bond rating is a measure of our credit-worthiness (analogous to an individual’s credit score), and is vital to ensuring that the City is able to receive affordable rates to finance large purchases.

As of 12/31/2021 the City had roughly $213 million in outstanding debt. Annual debt service payments in 2021 total to about $34 million (about 10% of all expenditures in the City’s budget)

How much does the City have in cash reserves?

One of the ways that the City ensures that we are able to respond effectively to changes in the economic environment (such as recessions or other economic stressors) is to keep adequate cash reserves on hand. These reserves help ensure that City services can be maintained during periods of temporary revenue shortages (such as during a recession, when tax revenue decreases significantly).

As of 12/31/2021, the City had roughly $363 million in cash on hand.

Where can I get a copy of the City’s budget?

The City’s annual budgets can all be obtained on the City’s online document repository, linked here: http://docs.southbendin.gov/WebLink/Browse.aspx?startid=1214

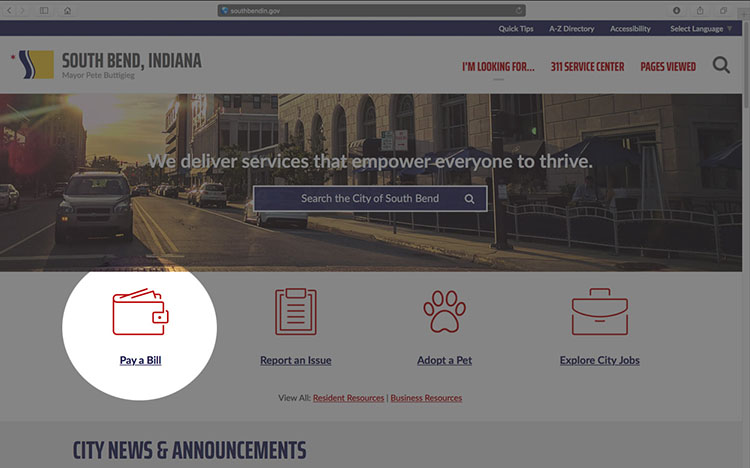

How can I be involved in the City’s budget process?

We need to hear from you! The City’s budget is dependent upon solid understanding of the strategic priorities of residents. In addition to filling out the online strategic priority survey available at https:southbendin.gov/budgetsurvey2022 , we would invite you to attend any and all of the City’s public budget meetings during the months of August, September and October. The schedule of budget hearings for 2022 is available and posted in the above section!

Where can I find the results of the budget surveys?

You can find the full report detailing the results of the 2022 budget feedback here! 2022 Budget Report 9.27.21

Thank you to all residents who participated in making this the City of South Bend’s largest budget feedback collection effort!